Blog

Chinese M&A's in Germany's industrial machinery industry

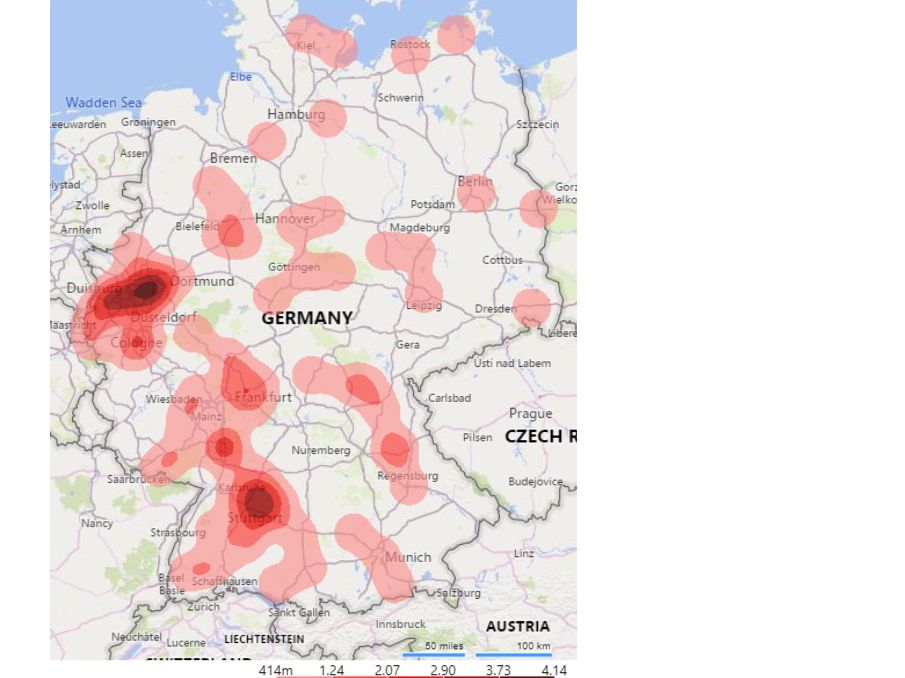

Chinese M&A activities in Germany’s industrial machinery industry peaked in 2016, in line with the overall trend of China's FDI in Germany. Between 2004-2018, Chinese companies were involved in 95 M&A transactions in the German industrial machinery industry. Of these investments, 60 were made in geographic clusters. The distribution of German firms and Chinese M&A's reveal similar location patterns, demonstrating the importance of clusters for Chinese investors.

moreThe Role of State Ownership in the Internationalization of Chinese Firms.

Overall, Chinese outward FDI covers over 170 countries. Especially, Chinese SOEs are prevalent players in outward FDI and with a large number of SOEs in China (18% of SOEs in the world economy are headquartered in China) they play a major role in the country's outward FDI expansion strategy. Therefore, China soutward FDI and political thinking are heavily intertwined what is reflected in the governmental strategies of China.

moreOnly here for the knowledge? Evidence of productivity spillovers from emerging market MNEs in Germany.

Chinese FDI in Germany has lately been a heavily debated topic, because dominantly positive experiences of German firms with Chinese investors contradict expectations of an aggressive, state-led takeover strategy of critical technologies bearing the risk of a loss of competitive advantage in the long run. To advance the discussion on this topic, we summarized the findings of a study by Vira Raskaley’s, written at the Chair in International Management and Governance (IMG), in this blog post.

moreThe German Angst? How Germany plans to protect its crown-jewel industries

Are developed countries afraid of losing their competitive advantages to emerging economies? The latest development of investment protection in the US, Germany and on the EU level might lead us to believe so. The US introduced an extension (FIRRMA) of CFIUS, Germany enhanced its investment scrutiny procedures in 2017 and discusses further steps, and the EU is in the process of implementing a common framework for the screening of FDI. These developments are not officially linked to the current increase in Chinese investment inflows, however, the unique climb in numbers and values surely a woke the developed world. Also, where it is not the sheer climb in volume, it’s the role of the state in the firms investing abroad that makes them re-think their current FDI screening mechanisms.

more