Is state ownership crucial for the internationalization of Chinese firms?

Author: Lara Herber; August 12, 2019

A few days ago China’s BAIC (China’s Beijing Automotive Group Co. Ltd.) bought a 5% stake in Daimler AG. Just last year, Chinese automaker Geely also purchased a large stake in Daimler AG (9.7%) worth 7.3 billion Euros. However, today’s Chinese investments are not limited to the German automotive sector. Major Chinese acquisitions can be found in the mechanical sector, such as the takeover of the mechanical engineering company Kuka by the Chinese company Midea for 4.5 billion Euros, or in the energy sector (100% acquisition of EEW Energy by Bejing Enterprises Holding Ltd.), both dating back to 2016.

What differentiates the various Chinese investments in German companies is not only the amount of shares or paid transaction value, but the type of Chinese ownership. BAIC and Bejing Enterprises, for example, are state-owned companies (SOE), Geely and Midea are privately-owned enterprises (POE). Both, SOEs and POEs, differ significantly in regard to their aims and resources. In particular, SOEs have privileged relationships with the government, soft budget constraints, and can enjoy more state backing in the form of higher encouragement of outward foreign investment as well as related services or trainings for investment abroad.

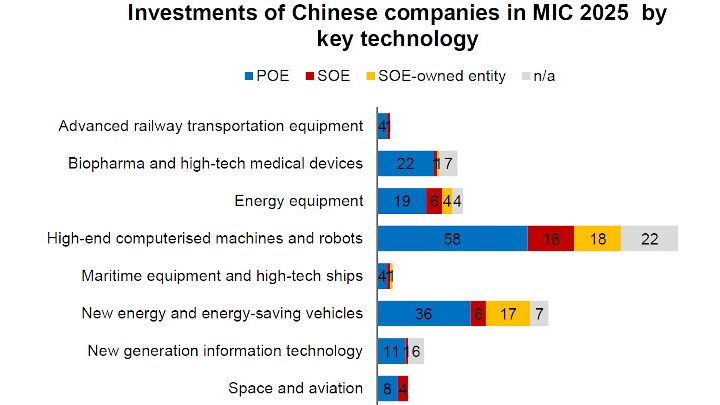

For discussing the question whether state ownership has an impact on Chinese investments in Germany, secondary data analysis is a helpful method. My analysis of Chinese foreign direct investment in Germany revealed three findings: First, more POEs than SOEs invest in German sectors. As pointed out in “Made in China 2025” (MIC 2025) (China’s industrial-political strategy for becoming a global leading country), both ownership types particularly invest into the German machinery and energy sectors.

Second, when entering Germany, both Chinese state-ran and private firms mainly choose the acquisition of majority stakes/100% ownership acquisition. Third, contrary to assumptions in the International Business literature that SOEs rely on substantial financial government support, my study only partially confirms this argument. When looking at average deal size, state-owned companies invest approximately 45% more in terms of money spent than their private counterparts. However, when looking at the total number of investments, SOEs have fewer investments in German companies than POEs.

Note: This blog post was written by the author of the attached Thesis - Lara Herber.For further details of the study, click here.

References

China’s Geely Buys $9 Billion Daimler Stake. (2018). Retrieved July 28, 2019, from www.bloomberg.com/news/articles/2018-02-23/china-s-geely-is-said-to-be-buying-9-billion-stake-in-daimler

EEW Energy from Waste. (2019). Historie EEW Energy from Waste. Retrieved July 28, 2019, from www.eew-energyfromwaste.com/de/unternehmen/historie.html

Jungbluth, C. (2016). Chance und Herausforderung Chinesische Direktinvestitionen in Deutschland. Bertelsmann Stiftung.

Jungbluth, C. (2018). Kauft China systematisch Schlüsseltechnologien auf? Chinesische Firmenbeteiligungen in Deutschland im Kontext von „Made in China 2025“. Bertelsmann Stiftung und GED Studie.

Taylor, E., Bellon, T., & Clarke, D. (2016). China’s Midea receives U.S. green light for Kuka takeover. Retrieved July 28, 2019, from www.reuters.com/article/us-kuka-m-a-mideamidea-group-idUSKBN14J0SP

Taylor, E., & Sun, Y. (2019). China’s BAIC buys 5% Daimler stake to cement alliance. Retrieved July 28, 2019, from www.reuters.com/article/us-baic-daimler/chinas-baic-buys-5-daimler-stake-to-cement-alliance-idUSKCN1UI0IY