Research Projects

Statistics in Court

Publications of popular science criticize spectacular misinterpretations of statistical evicdence in court decisions. But there is no scientific research about consequences for legal methodologies or juridical education. Usage of statistical terminology and statistical evidence raises and gets more common at German courts. Anyway, popular cases of misinterpretation of statistical evidence in research appear more anecdotical than scientific. This research projects covers wide spaces of statistic methods and fields of law, especially criminal law and public law.

Judges and lawyers have the challenging task to review statistic issues and consider them appropiate when reaching a verdict. This research project examines how lawyers can be supported with the review of statistic issues. Primary statistic-didactic questions are adressed by this research project, like:

- Which kind of quantitative methodological competences are helpful for lawyers?

- How can these competences be teached in legal education?

- Can the quality of jurisdiction improve with such educational offers?

For answering this questions an analysis of basic legal topics is required: How can argumentation based on quantitative issues get subordinated transparent and consistent in legal methodoly? How are random principles and sample results arranged with the postulation of individual cases?

This research project is a joint project of the University of Bremen and the University of Applied Sciences Kiel.

Prevention and Identifiaction of Financial Fraud with Quantitative Methods

Manipulations and violations of regulations for creation of accounting data is a serious crime with the potential of huge economic and social consequences. Reports about fraud, evasion and reduction of taxes can be found regularly in daily press and causes financial damage for the government as well as social injustice in society. Fraud in financial reports for commercial or exchange law leads to inefficient capital markets, investors get mislead by false information and are not able to allocate their capital optimal anymore. With greater interdependence of international capital markets and secular trends of turning away from governmental pay-as-you-go pension systems to private capital market orientated pension, comes even more social damage.

Identification of fraud cases is difficult, since fraud occurs rare, company structures getting more complex (especially driven by digitalization) and databases are getting bigger. So the usage of statistical methods is indispensable for auditors, tax authority and other regulatory institutions for fraud detection.

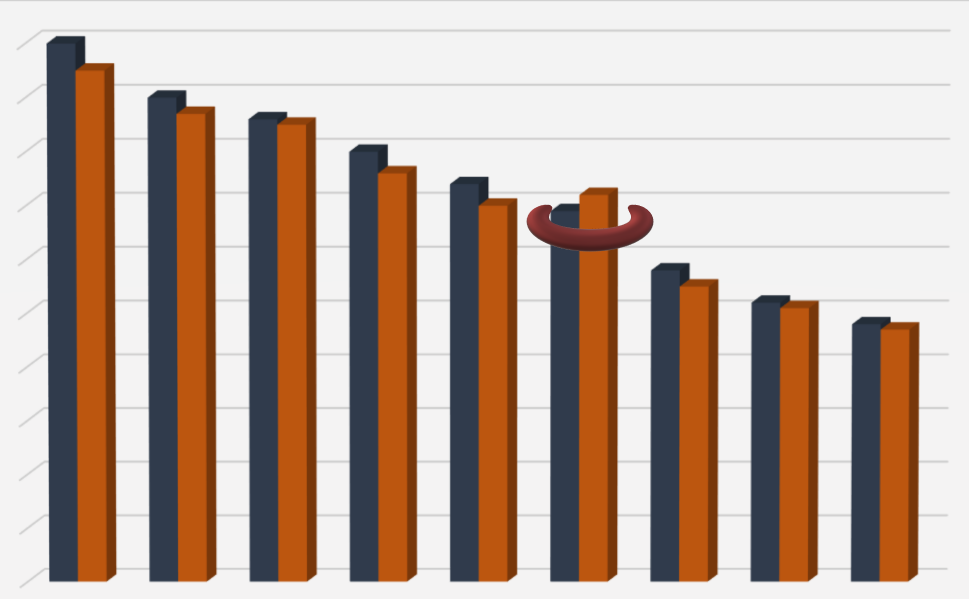

In this research project, various statistical methods for fraud detection in tax or accounting data get evaluated. Used methods range from distribution tests and time series comparisons to interactive audit networks, like „Summarische Risikoprüfung“, and methods of unsupervised and supervised machine learning (especially Bayesian Networks and Neural Networks) for classification tasks. Simultaneously the permission by law of these methods for start for investigations and for evidence in court is analyzed, as well as consequences for legislation.

Wavelet Analysis in Risk Management

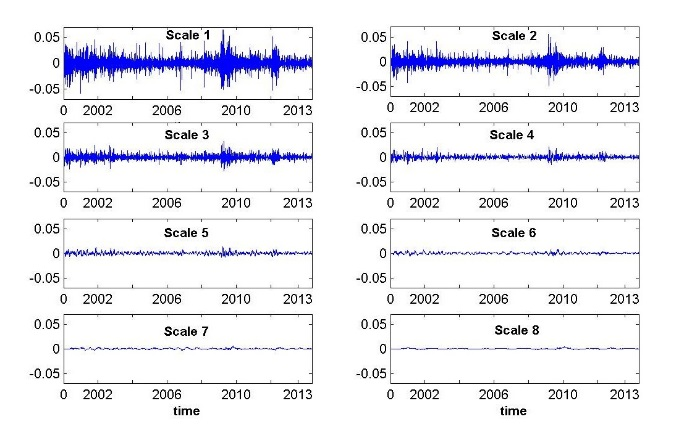

We decompose financial return series into different time scales to separate short-term noise from long-term trends. Moreover, we investigate dependence between stocks at different time scales before and after the outbreak of financial crisis. As well, we set up a novel application and introduce the application of decomposed return series to a portfolio management setup and model portfolios which minimize the volatility of each particular time scale.